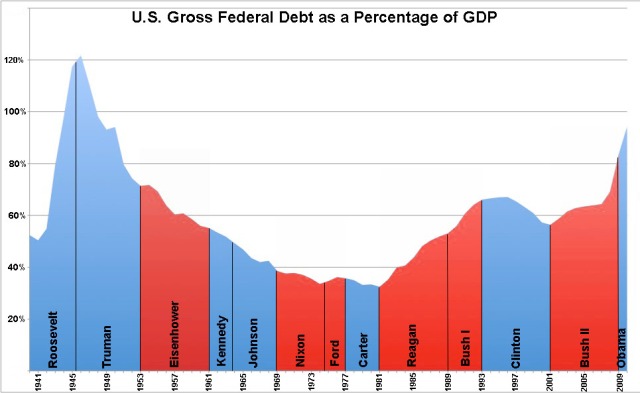

This debate on debt and federal spending has me wondering if anyone pays attention to U.S. history. With today marking the 150th anniversary of the attack on Ft. Sumpter, the event which unleashed four years of civil war, I thought it would be useful to look at the big picture before our nation today is torn asunder. And I mean big picture, history past Ronald Reagan, where most conservatives would like to stop. I mean just take a look at the graph, and you may understand why.

There are two inevitabilities in the political economy, and they are revenue and spending. Those two factors alone determine the total amount of US fiscal debt. Thats it. Often this is made out to be some confusing theoretical economic policy battle, but in reality its about taxes and spending and what we do to get to that total debt number. Take a close look at that chart, total US federal debt as a percentage of GDP, and you will notice a trend after 1981. What happened in 1981? President Reagan and Milton Friedman, champions of supply-side economics and armed with the Laffer Curve, implemented what is commonly referred to as Reaganomics, by lowering the top marginal tax rate and not adjusting the spending levels.

The noteable thing about this graph is it puts the current policy battle over eliminating the Bush-era tax cuts into perspective. Throughout history the top income brackets paid high prices to earn their money and live in the United States. In fact, the only period of time that top marginal tax rates were as low as they are today was between 1923 and 1930 the period leading up to the great depression. Today, businesses and high income earners pay 35%, whereas in the booming nineties they paid a whopping 39%. Thats right, we are arguing over a 4% increase. You can draw your own conclusions as to the underlying graph above, and about how income inequality is vast and reaching depression-era levels. But you cannot deny the correspondence between the dramatic increase in the US federal debt and the decrease in taxing individuals who make millions.

And before you even say it out loud:

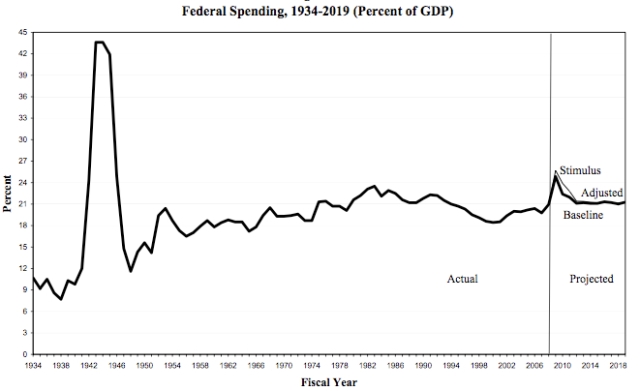

Federal spending as a percentage of GDP over the past century has remained largely consistent. Yes there has been a slight up-tick since the 2008 TARP (Bush bailout) and 2009 stimulus (Obama spending program) but with some exceptions (World War II) federal spending has remained fairly constant overtime.

It is important to keep these things in mind. 150 years ago, a rich southern agricultural aristocracy seceded from the industrialized Union over the issue of slavery, wanting to own African-Americans as property. Revisionist historians would like to say that the southern states seceded over states rights. But those same revisionists will tell say 100 years from now that this battle we are currently fighting is about debt, when in fact we know it’s about taxes.

Well said! Although maybe a graph of government revenue over time could help emphasize your point.